芜湖CFA笃学优享计划

芜湖CFA笃学优享计划

- 上课时段:详见详情

- 教学点:1个

- 开班时间:滚动开班

- 课程价格:请咨询

- 已关注:748

- 优惠价格:请咨询

- 咨询电话: 400-008-6280

- 微信咨询:tan4811

每日一练:CFA考试题英文版试题(2020.6.10)

Which of the following is least likely to be considered a warning sign of aggressive revenue recognition?

A) Bill and hold arrangements.

B) Capital-type leases.

C) Recognizing revenue from barter transactions with third parties.

D) Sales-type leases.

The correct answer was B) Capital-type leases.

Sales-type leases in which the lessor recognizes a sale at the inception of the lease can be used to book revenue too soon. Capital-type leases do not have this impact because they recognize revenue over the life of the lease. Bill and hold arrangements and recognizing revenue from barter transactions can also be used to manipulate revenue.

This question tested from Session 7, Reading 30, LOS c

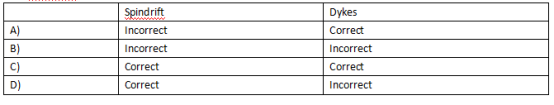

Are Spindrift’s and Dyke’s statements about earnings manipulation at Sunbeam correct?

The correct answer was A) Incorrect Correct

Spindrift’s statement is incorrect. Receivables and inventories increasing faster than sales was a sign of earnings manipulation at Sunbeam. Sales increasing faster than receivables and inventories can be a sign of more efficient operations. Dykes’ statement is correct.

This question tested from Session 7, Reading 30, LOS c

The correct adjustments for PP&E and long-term debt would be closest to:

The correct answer was C) +$125 +$225

PP&E would be adjusted up by the $125 present value of long-term leases for a total value of $425 + $125 = $550. Long-term debt would be calculated at market value and adjusted up for the present value of long-term leases: $500 + $125 = $625 relative to a reported value of $400, for an adjustment of +$225.

This question tested from Session 7, Reading 30, LOS c

Which of the following was least important as a warning sign of earnings manipulation at Enron in its financial statements for the fiscal year 2000?

A) Use of the equity method to account for investments and reporting pro-rata earnings of the investee in net income.

B) Related party transactions in which an Enron employee served as general partner in limited partnerships engaging in transactions with Enron.

C) Sales of securitized assets at inflated values to SPEs.

D) Senior management’s compensation was based mostly on bonus and stock awards.

The correct answer was A) Use of the equity method to account for investments and reporting pro-rata earnings of the investee in net income.

In the equity methods, the pro-rata earnings of the investee are correctly reported in net income. Enron’s misuse of the equity method involved reporting the investments at fair value, not including pro-rata earnings in net income. The other statements are all examples of red flags in Enron’s fiscal year 2000 financial statements.

This question tested from Session 7, Reading 30, LOS c

扫描二维码免费领取试听课程

登录51乐学网

注册51乐学网